san antonio general sales tax rate

Download all Texas sales tax rates by zip code. The December 2020 total local sales tax rate was also 63750.

How Texas Spends Its Money How Texas Gets Its Money Why It Doesn T Add Up

The average cumulative sales tax rate in San Antonio Texas is 822.

. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. The December 2020 total local sales tax rate was also 8250. Every 2019 combined rates mentioned.

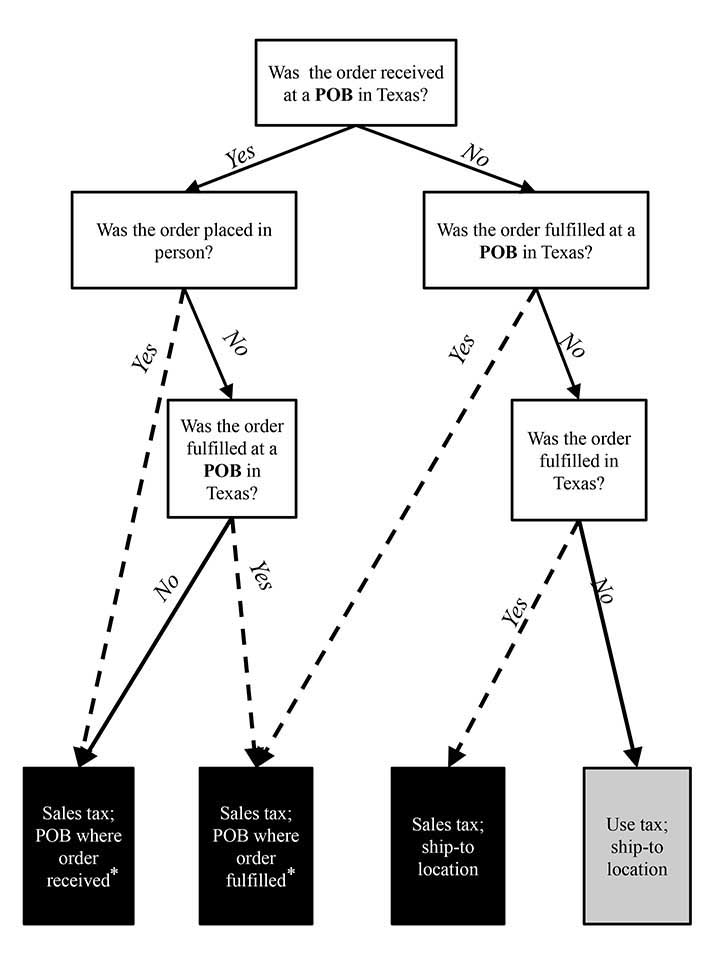

The sales tax jurisdiction. City sales and use tax codes and rates. The San Antonio Texas general sales tax rate is 625.

The San Antonio Texas sales tax is 625 the same as the Texas state sales tax. The 1675 hotel occupancy tax in San Antonio provides millions of dollars to support the convention and visitors bureau local arts history and preservation efforts maintain and. The sales tax jurisdiction.

This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for San Antonio Texas is. How do you figure out sales tax in San Antonio.

The San Antonio Texas general sales tax rate is 625. Depending on the zipcode the sales tax rate of San Antonio may vary from 63 to 825. San Antonio has parts of it located within Bexar.

While many other states allow counties and other localities. San Antonio TX 78283-3966. Every 2018 combined rates.

The combined rate used in this calculator 825 is the result of the Texas state rate 625 the San Antonio tax. View the printable version of city rates. The current total local sales tax rate in San Antonio NM is 63750.

The San Antonio sales tax rate is 825. The San Antonio Mta Texas sales tax is 675 consisting of 625 Texas state sales tax and 050 San Antonio Mta local sales taxesThe local sales tax consists of a 050 special. There is no applicable county tax.

The 78216 San Antonio Texas general sales tax rate is 825. This includes the rates on the state county city and special levels. The current total local sales tax rate in San Antonio TX is 8250.

City Sales and Use Tax. Texas Comptroller of Public Accounts. Monday - Friday 745 am - 430 pm Central Time.

The 78216 San Antonio Texas general sales tax rate is 825. What is the sales tax rate in San Antonio Texas. The 825 sales tax rate in San Antonio consists of 625 Puerto Rico state sales tax 125 San Antonio tax and 075 Special taxThere is no applicable county tax.

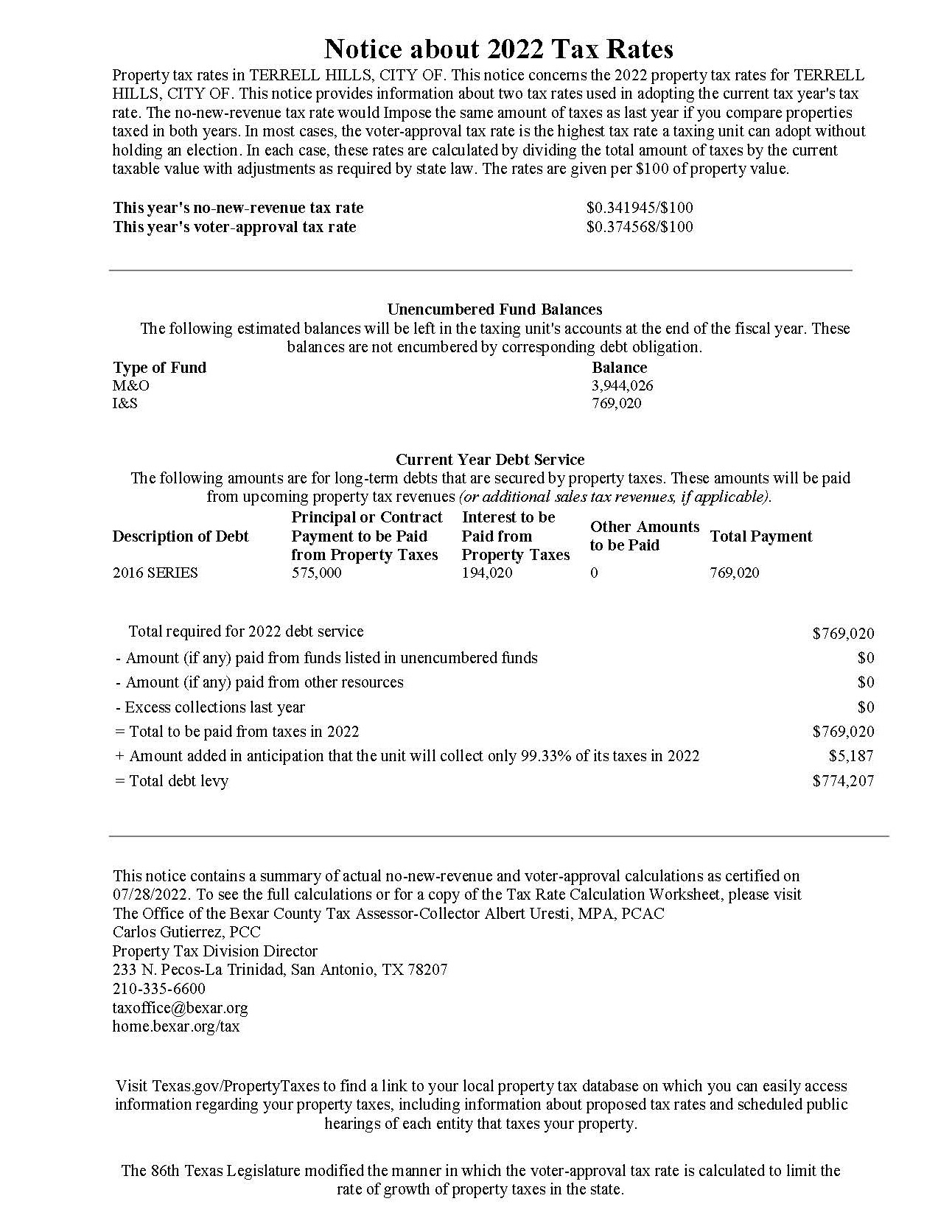

City of San Antonio Property Taxes are billed and collected by the Bexar County. The portion of the sales tax rate collected by San Antonio is 125 percent.

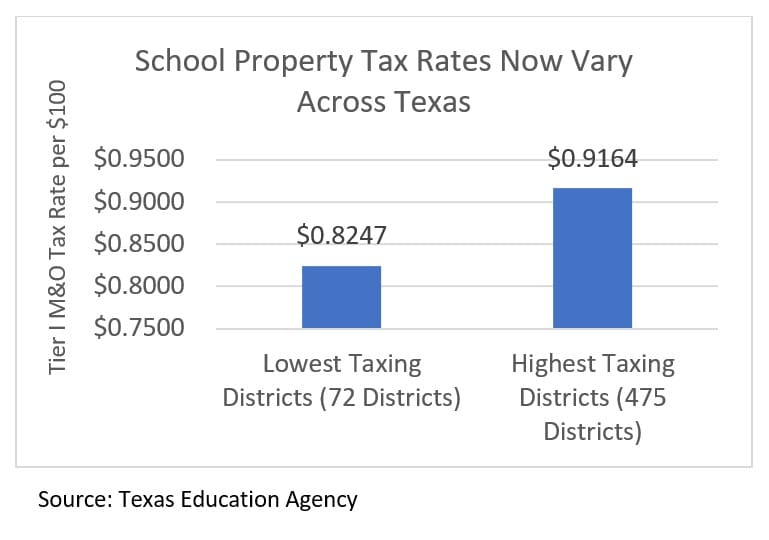

A New Division In School Finance Every Texan

Tax Breaks For Developers Under Scrutiny In San Antonio Texas Capitol San Antonio News San Antonio San Antonio Current

U S Cities With The Highest Property Taxes

Tax Rates Bexar County Tx Official Website

Texas Sales Tax Rates By City County 2022

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

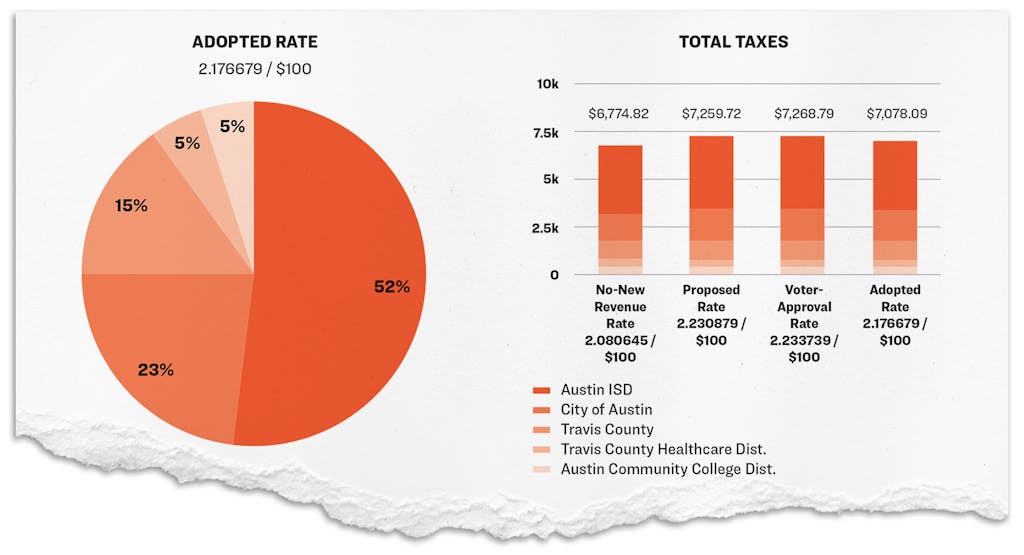

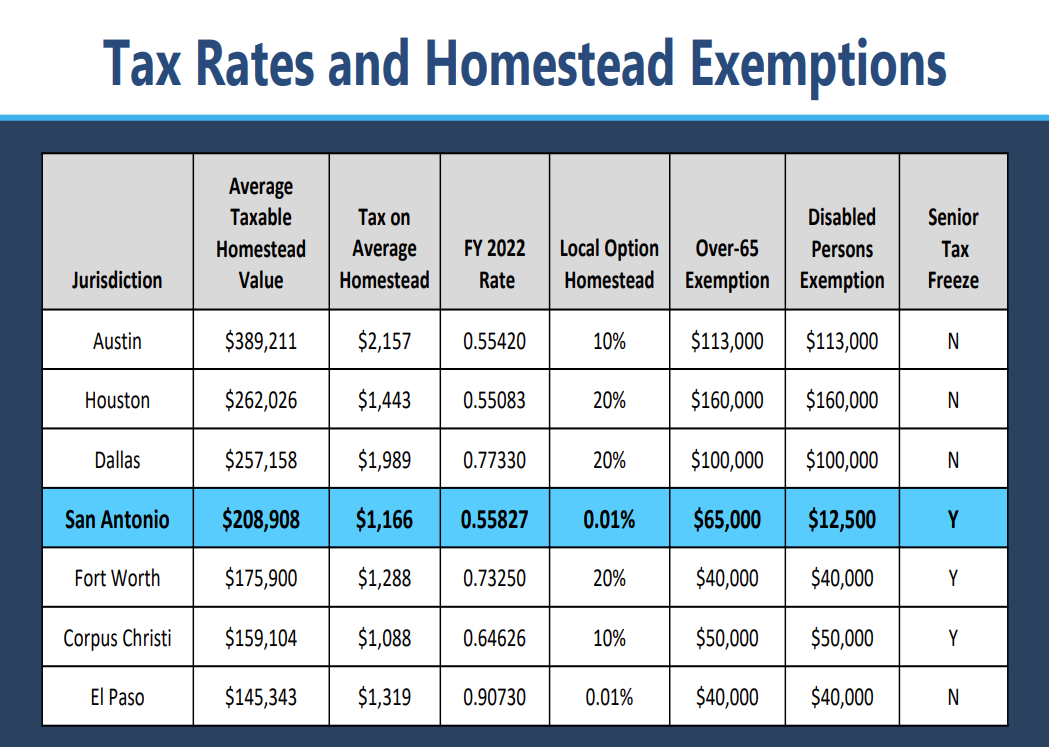

Local Tax Rates And Exemptions 2018 Texas Cities San Antonio Report

Texans Don T Pay More Taxes Than Californians Do Reports Show Texas Thecentersquare Com

What Is The San Antonio Sales Tax Rate The Base Rate In Texas Is 6 25

About San Antonio River Authority

:watermark(cdn.texastribune.org/media/watermarks/2019.png,-0,30,0)/static.texastribune.org/media/files/85e20dce251581d7db5bf518e23efd18/06_Abbott_State_of_the_State_MG.jpg)

Texas Sales Tax Increase Would Hit Poor People The Hardest The Texas Tribune

Tac School Finance The Elephant In The Property Tax Equation

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Tax Rates And Local Exemptions Across Texas San Antonio Report

Texas Sales Tax In 2017 What You Need To Know The Motley Fool